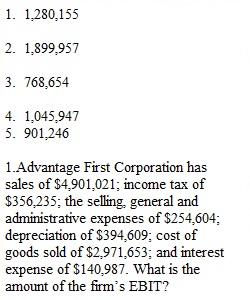

Q 1.Advantage First Corporation has sales of $4,901,021; income tax of $356,235; the selling, general and administrative expenses of $254,604; depreciation of $394,609; cost of goods sold of $2,971,653; and interest expense of $140,987. What is the amount of the firm’s EBIT? 2.Evening Story Corporation has sales of $4,561,397; income tax of $569,597; the selling, general and administrative expenses of $252,139; depreciation of $344,533; cost of goods sold of $2,661,440; and interest expense of $123,229. Calculate the amount of the firm’s gross profit. 3.Banana Box Corporation has sales of $4,431,507; income tax of $545,867; the selling, general and administrative expenses of $284,549; depreciation of $301,219; cost of goods sold of $2,907,357; and interest expense of $169,728. Calculate the amount of the firm’s income before tax? 4.Garden Pro Corporation has sales of $4,726,468; income tax of $509,963; the selling, general and administrative expenses of $245,275; depreciation of $316,390; cost of goods sold of $2,446,666; and interest expense of $162,227. Calculate the firm’s net income? 5.Killer Whale, Inc. has the following balance sheet statement items: total current liabilities of $898,205; net fixed and other assets of $1,965,198; total assets of $2,866,444; and long-term debt of $696,458. What is the amount of the firm’s current assets?

View Related Questions